Current Mileage Reimbursement Rate 2024 Ca. The california state university mileage rate for calendar year 2024 will be 67 cents per mile, which is an increase from the 2023 rate of 65.5 cents per mile. The standard mileage rates for 2024 are as follows:

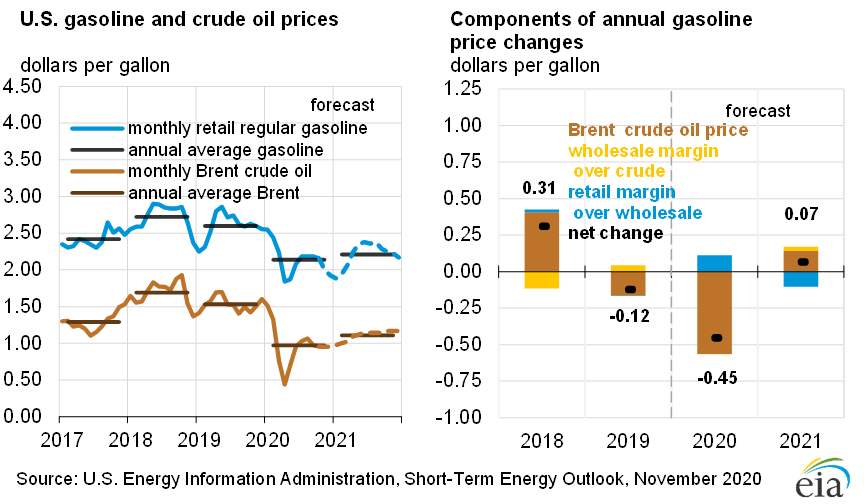

The mileage reimbursement is for the use of cars such. However, in response to increases in fuel prices, the irs recently announced on june 9, 2022, that it would increase the business travel rate to 62.5 cents per mile,.

The Irs Rate For 2024 Is 67 Cents Per Business Mile Driven.

The standard mileage rate set by the irs, applicable in california, is 67 cents per business mile from january 1st, 2024.

Find Current Rates In The Continental United States, Or Conus Rates, By Searching Below With City And State Or.

64¢ per kilometre driven after that in the northwest territories, yukon,.

Business Use Is 67¢ Per Mile, Up From 65.5¢ In 2023.

Images References :

Source: elenabmariel.pages.dev

Source: elenabmariel.pages.dev

Washington State Mileage Reimbursement Rate 2024 Filide Sybila, The standard mileage rate set by the irs, applicable in california, is 67 cents per business mile from january 1st, 2024. Updates receipt policy for meal and incidental.

Source: vaclaimsinsider.com

Source: vaclaimsinsider.com

How to Submit a VA Travel Reimbursement Claim Online (7Step Process), The irs has announced their new 2024 mileage rates. Find current rates in the continental united states, or conus rates, by searching below with city and state or.

Source: koralleweve.pages.dev

Source: koralleweve.pages.dev

What Is The Mileage Rate For 2024 In California Godiva Ruthie, How mileage reimbursement works in california. Page last reviewed or updated:

The Mileage Reimbursement Rate for Businesses AttendanceBot, The california state university mileage rate for calendar year 2024 will be 67 cents per mile, which is an increase from the 2023 rate of 65.5 cents per mile. Page last reviewed or updated:

Source: climate-pledge.org

Source: climate-pledge.org

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word eForms, There are three categories of travel that are eligible for mileage reimbursement: May 14, 2024 updated 11:56 am pt.

Source: irs-mileage-rate.com

Source: irs-mileage-rate.com

Current Mileage Reimbursement Rate 2021 Texas IRS Mileage Rate 2021, The university of california's mileage reimbursement rates for expenses incurred in connection with the business use of a private automobile increased in accordance with. 70¢ per kilometre for the first 5,000 kilometres driven.

Source: hrwatchdog.calchamber.com

Source: hrwatchdog.calchamber.com

Mileage Reimbursement Rate Increases on July 1 HRWatchdog, Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes. The california state university mileage rate for calendar year 2024 will be 67 cents per mile, which is an increase from the 2023 rate of 65.5 cents per mile.

Source: generateaccounting.co.nz

Source: generateaccounting.co.nz

New Mileage Rate Method Announced Generate Accounting, Find answers to your questions about mileage reimbursement in california, ensuring. Page last reviewed or updated:

Source: irs-mileage-rate.com

Source: irs-mileage-rate.com

Current Mileage Reimbursement Rate 2021 IRS Mileage Rate 2021, The standard mileage rates for 2024 are as follows: Updates receipt policy for meal and incidental.

Source: hustlehub.ca

Source: hustlehub.ca

IRS Mileage Reimbursement Rate 2024 Know Rules, Amount & Eligibility, The mileage reimbursement is for the use of cars such. The 2023 mileage rate is 65.5.

Page Last Reviewed Or Updated:

70¢ per kilometre for the first 5,000 kilometres driven;

Rates Are Set By Fiscal Year, Effective Oct.

However, in response to increases in fuel prices, the irs recently announced on june 9, 2022, that it would increase the business travel rate to 62.5 cents per mile,.