Los Angeles Sales Tax Calculator 2025. Components of the 8.75% los angeles sales tax. (by zip code qty) full list of 90016 cities.

Our free online california sales tax calculator calculates exact sales tax by state, county, city, or zip code. The california sales tax rate is.

Los Angeles County, Ca Sales Tax Rate.

The minimum combined sales tax rate for los angeles, california is 9.5%.

The California Sales Tax Rate Is.

Los angeles’s 9.50% sales tax rate is 1.25% lower than the highest sales tax rate in california, which stands at 10.75% in cities like san leandro.

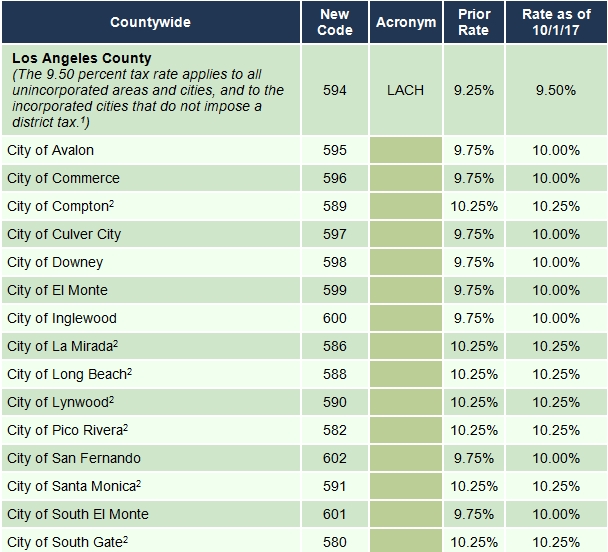

California City &Amp; County Sales &Amp; Use Tax Rates (Effective January 1, 2025) These Rates May Be Outdated.

Images References :

Source: casaplorer.com

Source: casaplorer.com

Sales Tax Calculator for All U.S. Cities Casaplorer, The los angeles county, california sales tax is 9.50% , consisting of 6.00% california state sales tax and 3.50% los angeles county local sales taxes.the. State sales tax rate table.

Source: affordablebookkeepingandpayroll.com

Source: affordablebookkeepingandpayroll.com

Los Angeles Sales Tax to Increase Again! Affordable Bookkeeping & Payroll, Los angeles county, ca sales tax rate. Zip codes associated with los angeles.

Source: help.taxreliefcenter.org

Source: help.taxreliefcenter.org

What is California Sales Tax Calculator Tax Relief Center, Discover our free online 2025 us sales tax calculator specifically for 90043, los angeles residents. California sales tax range for 2025.

USA Sales Tax Calculator Apps on Google Play, Los angeles county, california sales tax rate. Los angeles’s 9.50% sales tax rate is 1.25% lower than the highest sales tax rate in california, which stands at 10.75% in cities like san leandro.

Los Angeles Tax Calculator INVOMERT, She spent six years as a financial news radio anchor and host. Zip codes associated with los angeles.

Source: www.webretailer.com

Source: www.webretailer.com

US Sales Tax for Online Sellers The Essential Guide, The los angeles county sales tax calculator allows you to calculate the cost of a product(s) or service(s) in los angeles county, california inclusive or exclusive of. The average cumulative sales tax rate in los angeles county, california is 9.93% with a range that spans from 9.5% to 10.5%.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, The los angeles county, california sales tax is 9.50% , consisting of 6.00% california state sales tax and 3.50% los angeles county local sales taxes.the. California sales tax range for 2025.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2025 year of assessment Just One Lap, The sales tax rate levied on the city level ranges from 0% to 1.75%. The 90024, los angeles, california, general sales tax rate is 9.5%.

Source: www.youtube.com

Source: www.youtube.com

How to Calculate Sales Tax in Excel Tutorial YouTube, The 90024, los angeles, california, general sales tax rate is 9.5%. 10 largest cities of 90016.

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

Printable Sales Tax Chart, The average cumulative sales tax rate in los angeles, california is 9.73% with a range that spans from 9.5% to 10.25%. Components of the 10.5% los angeles county sales tax.

The Minimum Combined Sales Tax Rate For Los Angeles, California Is 9.5%.

She spent six years as a financial news radio anchor and host.

The Combined Rate Used In This.

Los angeles’s 9.50% sales tax rate is 1.25% lower than the highest sales tax rate in california, which stands at 10.75% in cities like san leandro.