Ss Taxable Wage Base 2025. The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2023 wage base of $160,200. For 2023, the wage base was $160,200.

The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2023 wage base of $160,200. The taxable wage base will continue to increase as follows:

So, If You Earned More Than.

In 2023, the maximum taxable wage base for sdi was $153,164 and the sdi tax rate was 0.9 percent.

What Are The Maximum Social Security Wages For 2025?

The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2023 wage base of $160,200.

The Limit For 2023 And 2025 Is $25,000 If You Are A Single Filer, Head Of Household Or Qualifying Widow Or Widower With A Dependent Child.

Images References :

Source: www.johnsonblock.com

Source: www.johnsonblock.com

The 2021 “Social Security wage base” is increasing Johnson Block CPAs, The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2023 wage base of $160,200. Social security wage base 2025 increase.

Source: valareewflora.pages.dev

Source: valareewflora.pages.dev

Tax Calculator California 2025 Barb Marice, As a result, in 2025 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social security taxes. So, if you earned more than.

Source: www.mercer.com

Source: www.mercer.com

2023 Social Security, PBGC amounts and projected covered compensation, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. The maximum social security wages, or social security wage base for 2025.

Source: www.aatrix.com

Source: www.aatrix.com

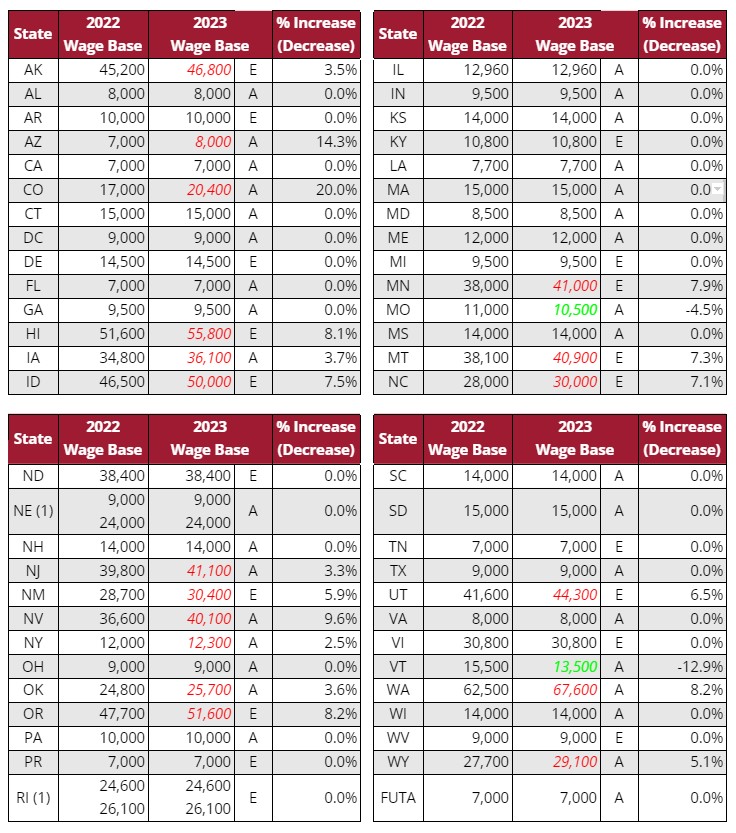

(1) The higher wage base only applies to employers assigned the maximum, The social security wage base — the amount of. The wage base changes each year, with an adjustment based on the national average wage index ,.

Source: what-benefits.com

Source: what-benefits.com

How Ss Benefits Calculated, Time to update your payroll system: For each year thereafter, computed as 16% of the state's average annual.

Source: calbudgetcenter.org

Source: calbudgetcenter.org

Modernizing Employer Payroll Taxes & Covering the True Costs of, For 2025, the irs has set the following wage bases: 2% social security tax on the first $168,600 of wages (6.2% x $168,600 makes the maximum tax $10,453.20), plus.

Source: www.cbmcpa.com

Source: www.cbmcpa.com

Increase Social Security Wage Base Washington DC CPA Firm, So, if you earned more than. You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

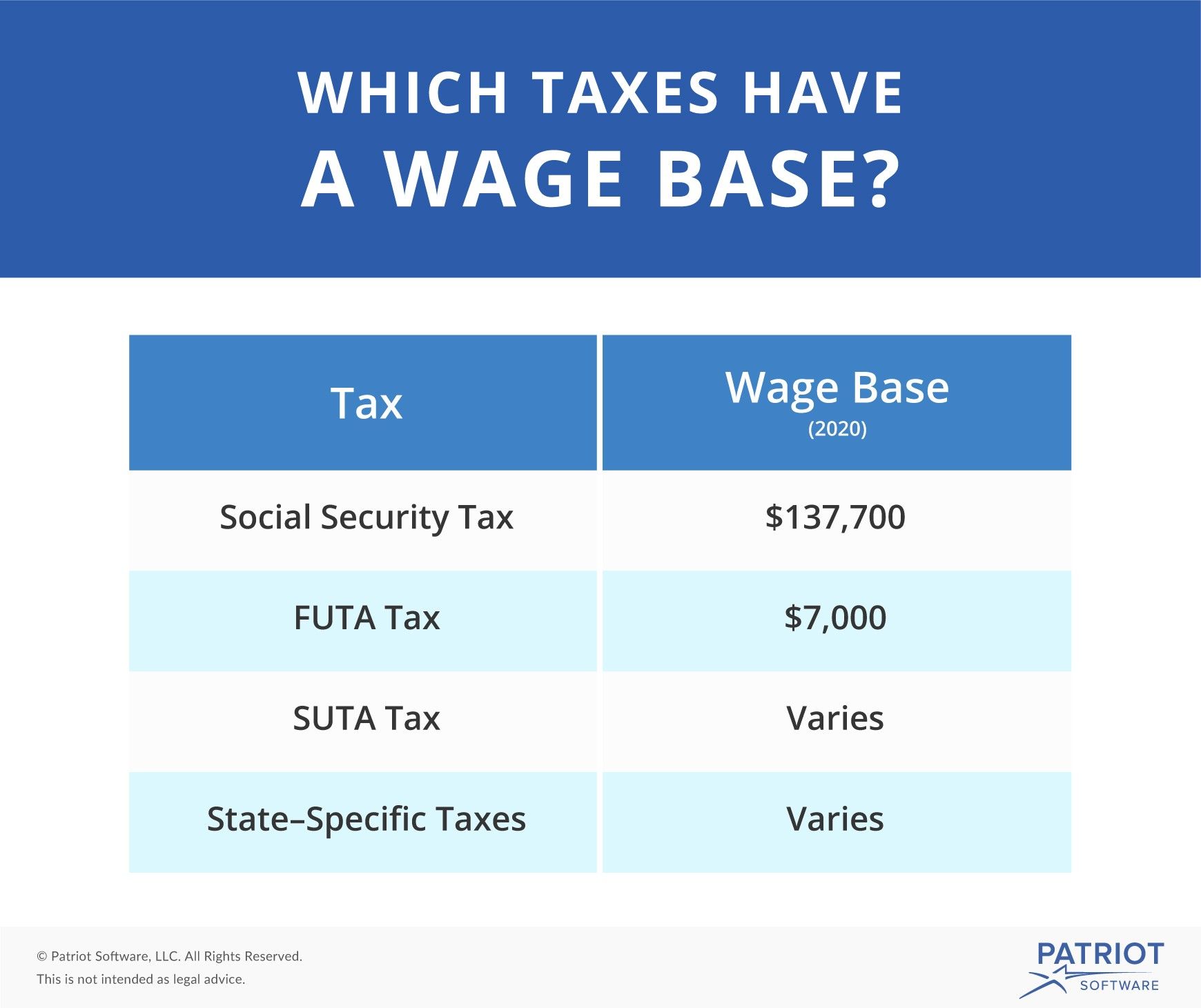

What Is a Wage Base? Definition, Taxes With Wage Bases, & More, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. Time to update your payroll system:

Source: www.clevelandgroup.net

Source: www.clevelandgroup.net

Proposed Law Would Increase the Social Security Taxable Wage Base, The taxable wage base will continue to increase as follows: For 2025, the irs has set the following wage bases:

Source: thomas-and-company.com

Source: thomas-and-company.com

Fraud Reminders CT, OH, & OR + NV 2025 Taxable Wage Base Updated, The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2023 wage base of $160,200. So, if you earned more than.

Ssa Has Announced The 2025 Social Security Taxable Wage Base.

The social security wage base is $168,600, up from $160,200.

The 2023 And 2025 Limit For Joint Filers Is.

The maximum social security wages, or social security wage base for 2025.